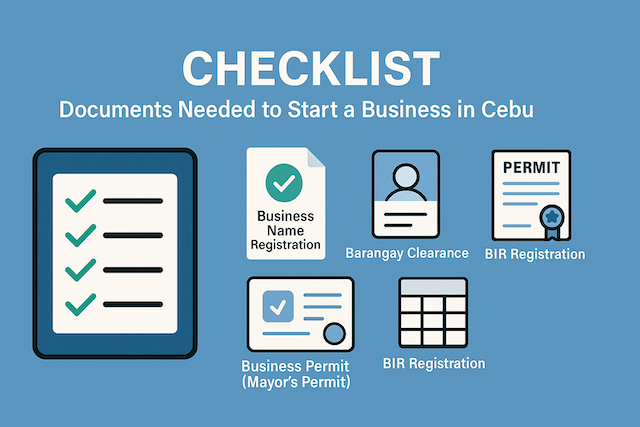

Checklist: Documents Needed to Start a Business in Cebu

Contents

- Checklist: Documents Needed to Start a Business in Cebu

- ️ 1. Introduction: Why Start a Business in Cebu?

- 2. Choosing the Right Business Structure

- 3. Step-by-Step Process to Start a Business in Cebu

- Step 1: Business Name Registration

- Step 2: Barangay Clearance

- Step 3: Mayor’s Permit (Business Permit)

- Step 4: BIR Registration

- Step 5: Register with SSS, PhilHealth, and Pag-IBIG

- ✅ 4. Document Checklist: What You’ll Need to Prepare

- ✅ Business Name Registration

- ✅ Barangay Clearance

- ✅ Business Permit (Mayor’s Permit)

- ✅ BIR Registration (Tax Identification Number & Official Receipts)

- ✅ SSS, PhilHealth, and Pag-IBIG Registration

- ✅ Other Applicable Permits / Industry-Specific Requirements

- Optional but Recommended

- Final Tips

- Frequently Asked Questions

- What should I do first?

- Where do I get a Barangay Clearance?

- When do I need to apply for the Mayor’s Permit?

- When should I register with the BIR?

- Can I use my home as my business address?

- Can I do these registrations online?

- I’m a sole proprietor but want to hire staff. What do I need?

- How long does the full process take?

- Can I hire someone to handle all the registrations?

- Can foreigners start a business in Cebu?

Checklist: Documents Needed to Start a Business in Cebu

️ 1. Introduction: Why Start a Business in Cebu?

Cebu, often dubbed the “Queen City of the South,” is one of the Philippines’ fastest-growing economic hubs. With a strategic location in the Visayas region, Cebu offers a thriving mix of urban energy and provincial charm—making it an attractive destination for entrepreneurs.

Its booming tourism industry, rapidly expanding BPO sector, access to skilled labor, and business-friendly local government make Cebu a competitive alternative to Metro Manila. Whether you’re launching a cafe, a tech startup, or a consulting agency, Cebu offers the infrastructure, customer base, and cost efficiency to grow your venture.

For foreign investors, Cebu also serves as a gateway to regional markets, offering access to talent and resources at a fraction of the cost compared to more saturated business centers. Plus, English proficiency and cultural compatibility give the Philippines—and Cebu in particular—a unique edge in Southeast Asia.

2. Choosing the Right Business Structure

Before diving into the paperwork, you need to decide what kind of business entity fits your needs. The Philippines offers several business structures, each with different legal and tax implications:

✅ Sole Proprietorship

-

Best for: Small businesses, freelancers, or solo entrepreneurs

-

Registered with: DTI (Department of Trade and Industry)

-

Ownership: One person only

-

Pros: Simple, inexpensive, full control

-

Cons: Unlimited personal liability

✅ Partnership

-

Best for: Two or more individuals managing a business together

-

Registered with: SEC (Securities and Exchange Commission)

-

Types: General Partnership or Limited Partnership

-

Pros: Shared responsibility and funding

-

Cons: Liability can extend to all partners

✅ Corporation

-

Best for: Medium to large businesses or ventures seeking investors

-

Registered with: SEC

-

Types: Regular Corporation or One Person Corporation (OPC)

-

Pros: Limited liability, legal personality, easier access to funding

-

Cons: More regulatory requirements, complex setup

Tip for Foreigners: Some business sectors limit or prohibit foreign ownership. Always check the Foreign Investment Negative List (FINL) before choosing your structure.

3. Step-by-Step Process to Start a Business in Cebu

Here’s a simplified overview of the key steps to legally register your business in Cebu:

Step 1: Business Name Registration

-

Where:

-

Sole Proprietor → DTI

-

Partnership/Corporation → SEC

-

-

How: Online via https://bnrs.dti.gov.ph or in person

-

Output: Business Name Certificate or SEC Registration Certificate

Step 2: Barangay Clearance

-

Where: Barangay Hall of your business location

-

Requirements:

-

DTI/SEC Registration

-

Valid ID

-

Proof of address (lease contract or land title)

-

-

Purpose: Local approval for operating within the community

Step 3: Mayor’s Permit (Business Permit)

-

Where: City or Municipal Hall (Business Permits and Licensing Office)

-

Requirements:

-

Barangay Clearance

-

DTI/SEC Certificate

-

Lease or land documents

-

Fire Safety, Sanitary, and Occupancy Permits

-

Valid ID and location sketch

-

-

Output: Mayor’s Permit to operate legally in the city

Step 4: BIR Registration

-

Where: Local BIR Revenue District Office

-

What you get:

-

Tax Identification Number (TIN)

-

BIR Form 2303 (Certificate of Registration)

-

Authority to Print Receipts

-

Books of Accounts

-

Step 5: Register with SSS, PhilHealth, and Pag-IBIG

-

Purpose: Required if you hire employees

-

Where: Local or online government portals

-

Documents Needed: DTI/SEC Registration, Mayor’s Permit, TIN

✅ 4. Document Checklist: What You’ll Need to Prepare

Starting a business in Cebu?

Here’s an expanded and practical checklist of the essential documents you’ll need to legally register, license, and operate your business in the Philippines.

Whether you’re a solo entrepreneur or launching a corporation, having the right paperwork in place will save you time, reduce delays, and ensure full compliance with local laws.

Use this list as your go-to reference during the registration process:

✅ Business Name Registration

Purpose: To legally register your business name and establish your identity.

-

For Sole Proprietorship:

☐ DTI (Department of Trade and Industry) Business Name Certificate

☐ Application form (online or in-person)

☐ Payment of registration fee (based on territorial scope) -

For Partnership or Corporation:

☐ SEC (Securities and Exchange Commission) Certificate of Registration

☐ Articles of Partnership / Incorporation

☐ By-laws (for corporations)

☐ Name Verification Slip from SEC

☐ Treasurer’s Affidavit (for corporations)

Pro Tip: Use https://bnrs.dti.gov.ph/ to register your business name online with the DTI.

✅ Barangay Clearance

Purpose: To get approval from the local barangay (village office) where your business is located.

Requirements:

☐ DTI/SEC registration copy

☐ Valid ID of the business owner or representative

☐ Proof of business address (lease contract, land title, authorization letter if subleasing)

☐ Community Tax Certificate (CTC)

☐ Accomplished application form from the barangay

☐ Payment of barangay fees

⏱ Processing Time: Usually same-day or 1–2 business days.

✅ Business Permit (Mayor’s Permit)

Purpose: To operate legally within the city and comply with local business regulations.

Common Requirements:

☐ Barangay Clearance

☐ DTI/SEC Registration

☐ BIR Certificate of Registration (if already obtained)

☐ Lease contract or land title

☐ Fire Safety Inspection Certificate

☐ Sanitary Permit from the City Health Department

☐ Occupancy Permit or Building Permit (from City Engineering Office)

☐ Valid government-issued ID

☐ Sketch or map of business location

☐ Payment of business permit fees (based on capital and business type)

Note: Some cities now allow online business permit applications. Check https://businesspermit.cebu.gov.ph or the city website.

✅ BIR Registration (Tax Identification Number & Official Receipts)

Purpose: To obtain your TIN, register books of accounts, and print official receipts.

Requirements:

☐ Mayor’s Permit (or at least proof of application)

☐ DTI/SEC Registration

☐ Valid ID of owner/authorized person

☐ Lease contract / Land title

☐ BIR Forms (1901 for sole prop, 1903 for corp)

☐ Books of Accounts for stamping

☐ Payment for BIR registration fee (via eFPS or accredited bank)

☐ Application to print receipts (Form 1906) and sample receipt layout

Output:

-

BIR Certificate of Registration (Form 2303)

-

Authority to Print Official Receipts

-

“Ask for Receipt” Notice

✅ SSS, PhilHealth, and Pag-IBIG Registration

Purpose: To comply with employer responsibilities for government contributions.

You’ll need to register your business as an employer and enroll your employees.

-

SSS (Social Security System)

☐ R-1 Form (Employer Registration)

☐ R-1A (Employment Report)

☐ DTI/SEC Certificate

☐ Business permit -

PhilHealth

☐ ER-1 Form

☐ Business documents -

Pag-IBIG

☐ Employer Data Form

☐ SEC/DTI and Mayor’s Permit

All three now have online portals for easier employer registration.

✅ Other Applicable Permits / Industry-Specific Requirements

☐ FDA License to Operate (for food, drug, cosmetics, supplements)

☐ DOLE Registration (required if you have 10 or more employees)

☐ Environmental Compliance Certificate (ECC) or Certificate of Non-Coverage (CNC) from DENR

☐ BOI or PEZA Registration (for tax incentives, if qualified)

☐ Tourism Accreditation (if operating in hospitality, travel, etc.)

☐ BFAD / DA Permits (if involved in agriculture, food processing)

Optional but Recommended

☐ Company Bank Account (requires SEC/DTI, Mayor’s Permit, and valid IDs)

☐ Company Bylaws or Operating Agreement (for internal governance)

☐ Corporate Books (e.g., Minutes, Stockholders’ Ledger, etc.)

☐ Business Insurance (e.g., fire, liability, health)

Final Tips

-

Always bring originals and photocopies of documents.

-

Government offices may require documents to be notarized.

-

Double-check fees and operating hours before visiting.

-

Renew most registrations annually (BIR, Mayor’s Permit, etc.).

-

Keep digital backups of all important permits and certificates.

Frequently Asked Questions

What should I do first?

Start with business name registration. For sole proprietors, register with the DTI. For partnerships or corporations, register with the SEC. This is the first legal step to start your business.

Where do I get a Barangay Clearance?

Go to the barangay hall where your business is located. Bring your DTI/SEC certificate, valid ID, and proof of business address such as a lease contract or land title.

When do I need to apply for the Mayor’s Permit?

After getting your Barangay Clearance. The Mayor’s Permit must be secured from the City Hall before starting your business operations.

When should I register with the BIR?

Once you’ve secured or applied for your Mayor’s Permit, proceed to the BIR to register your TIN, books of accounts, and receipts.

Can I use my home as my business address?

Yes, as long as you can present a lease or land title. Some areas may restrict certain business types from operating in residential zones, so check local regulations.

Can I do these registrations online?

Yes, partially. DTI, BIR, SSS, PhilHealth, and Pag-IBIG offer online registration. Some cities in Cebu also have digital portals for business permits.

I’m a sole proprietor but want to hire staff. What do I need?

You must register as an employer with SSS, PhilHealth, and Pag-IBIG, and enroll your staff. If you employ 10 or more people, DOLE registration is also required.

How long does the full process take?

It depends. DTI and barangay clearance can be done in 1–2 days. Mayor’s Permit and BIR registration may take 3–7 days depending on the city and document completeness.

Can I hire someone to handle all the registrations?

Yes. Many agencies, accountants, and consultants offer business registration services in Cebu, including processing permits on your behalf.

Can foreigners start a business in Cebu?

Yes, but some industries have foreign ownership restrictions. Always check the Foreign Investment Negative List (FINL) and consult a legal advisor.